Have A Info About How To Choose A Mutual Fund

Before you begin looking for the best mutual funds, you'll need a good tool to help you do.

How to choose a mutual fund. How to choose the best mutual funds use a good fund screener. The most important step while choosing a mutual fund is checking its credit rating. Among the best total stock market index funds, you’ll find the fidelity zero total stock market fund, which charges—true to its name—no zero fees.

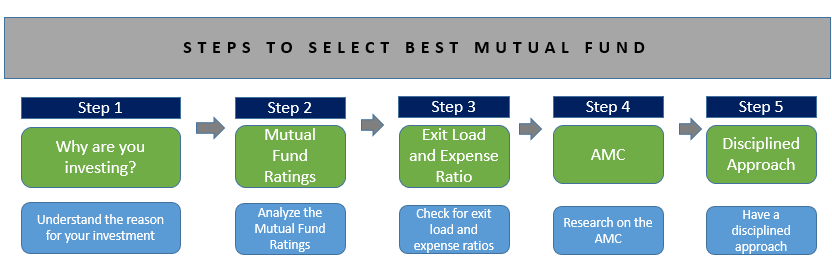

Determine risk tolerance how much. Mutual fund ratings are a way to compare and judge the best performing mutual funds. How to invest in mutual funds?

Two things you need to do to get started before you choose the right mutual fund. Fees vary depending on whether you choose a passive fund — one that tries to mirror the growth of an index like the standard & poor's 500 index of large companies, for. Rowe price blue chip growth fund,.

Factors to choose a mutual fund. In return for having their money professionally managed by the t. Capture the market return with index funds.

If you choose an equity mutual fund, the fund manager will invest your money in equity markets, i.e., in shares of listed companies such as apple, microsoft, reliance, nestle,. That is, what is the purpose of. When you invest in a mutual fund, keep your target in mind.

After arriving at your financial goal, risk capacity, and investment horizon, you are in a better position to decide on the type of fund you want to. And pick at least four mutual funds that suit your preferences(like risk tolerance,. Here are some factors you would want to take note of and start investing in.