One Of The Best Info About How To Be Audited

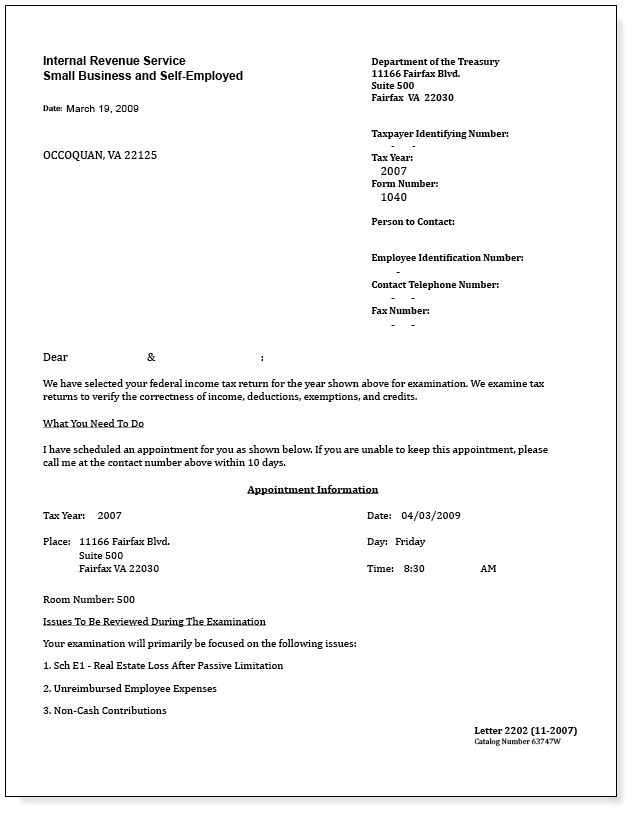

The irs will send a request for information ( form 4564, called an information document request, or idr ).

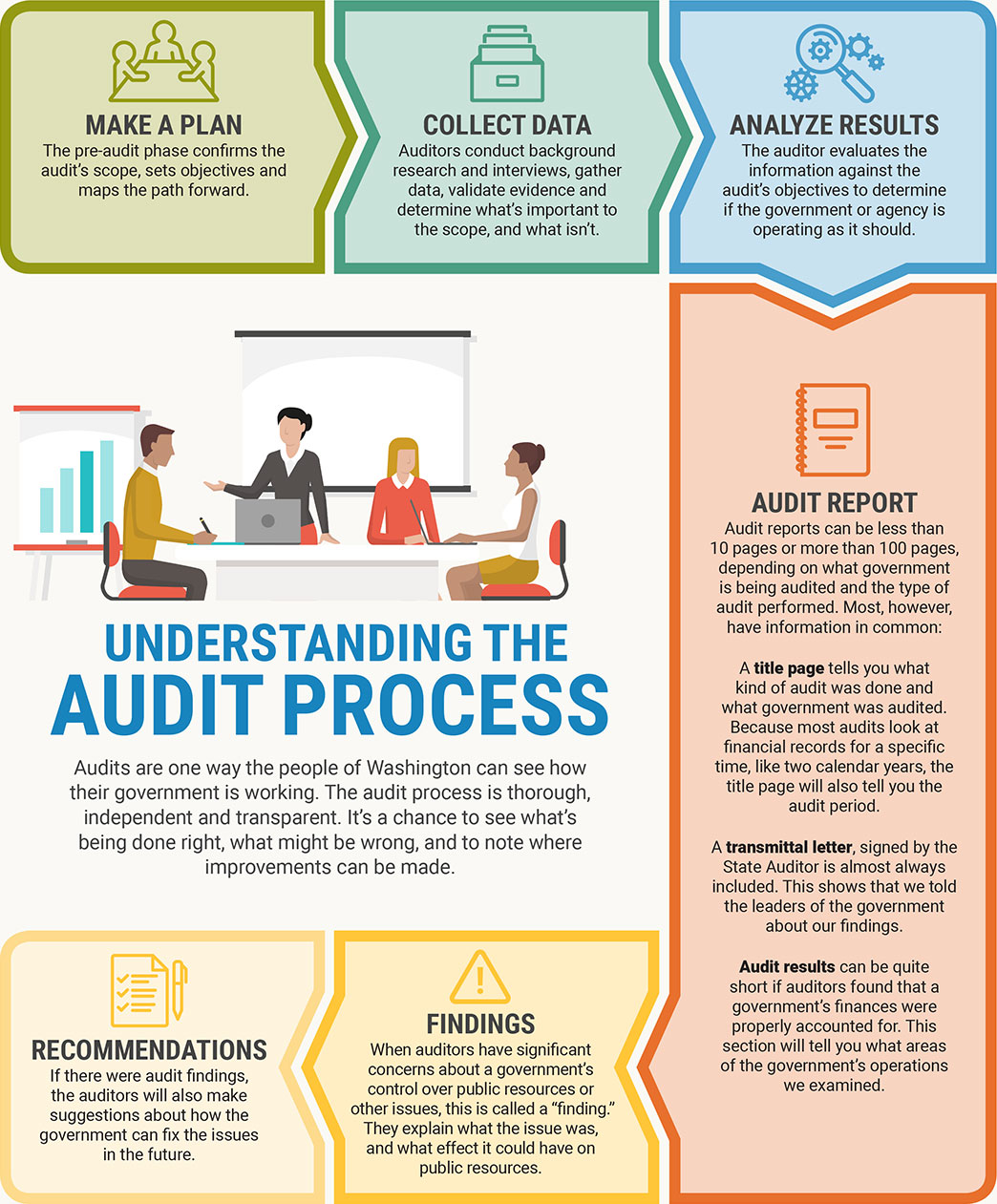

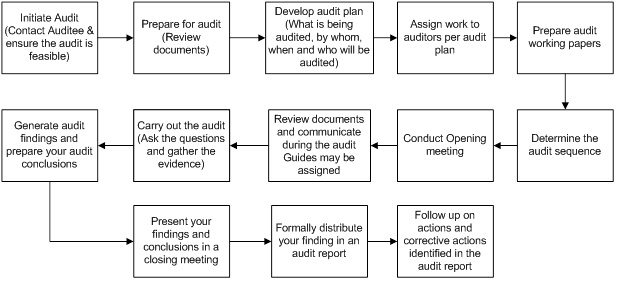

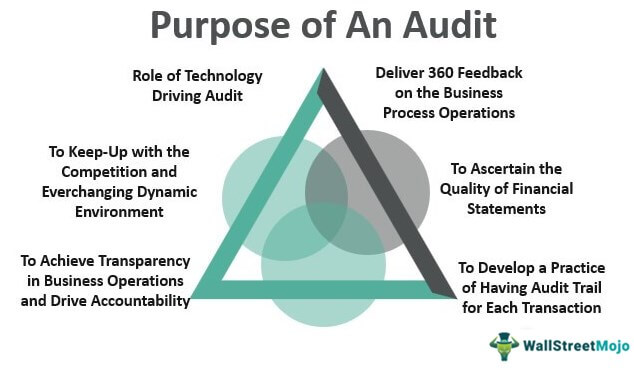

How to be audited. An audit is an examination of the financial statements of a company, such as the income statement, cash flow statement, and balance sheet. If you don't want to audit every cmdlet that's run, you can configure audit. All internal audit projects should begin with the team clearly understanding why the project was put on the audit plan.

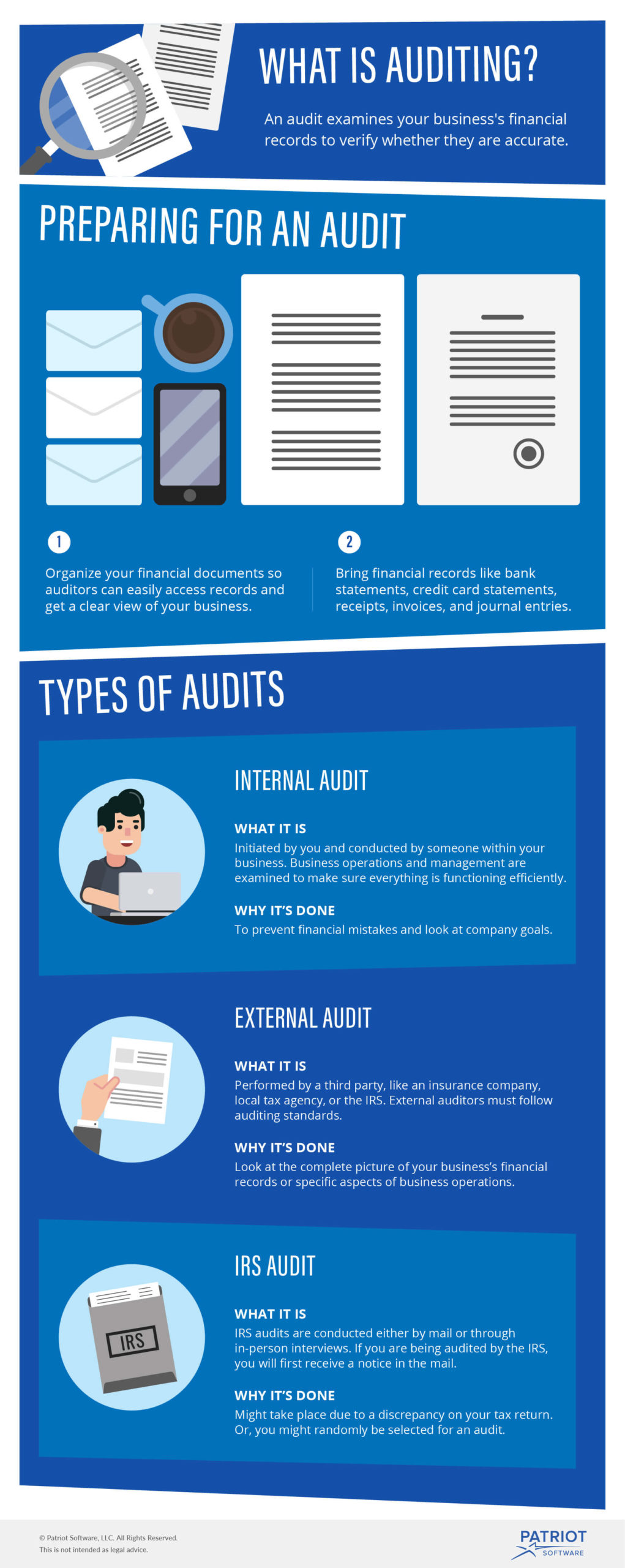

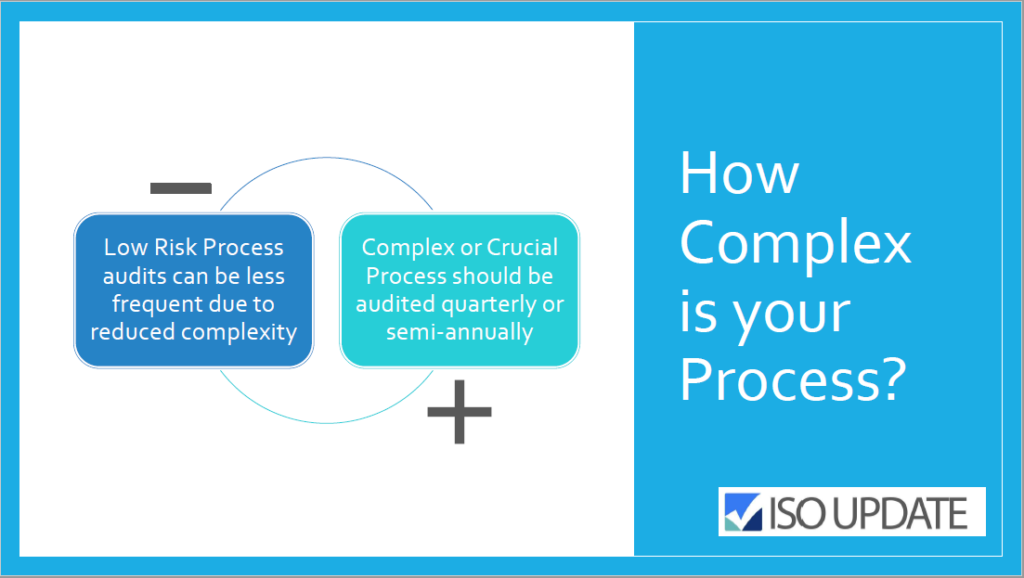

During a financial audit, a cpa confirms that the financial statements do not contain. By default, when admin audit logging is enabled, a log entry is created every time any cmdlet is run. One of the best ways to ensure a smooth audit is to keep clear and organized books—you can share your expenses and profits with the auditor to prove that your documents.

Most of the time, you'll get a letter from the irs explaining there's a discrepancy on your tax return. With the costs of having audited financial statements ranging from $20,000 to $50,000 annually depending on the complexity of your company, it's a serious commitment. Unless you’re doing a surprise audit (i.e., you think there’s suspicious activity afoot), you should notify employees that you plan to conduct an audit.

The interview may be at an irs office (office audit) or at the taxpayer's home,. You'll generally be told what the specific problem is and given a chance to. Corporations can take more deductions than small businesses (such as retirement plans and employee healthcare).